do tax assessors use zillow

Do tax assessors use zillow Monday July 25 2022 Edit. Annual property taxes are determined by multiplying the assessed fair market value against the.

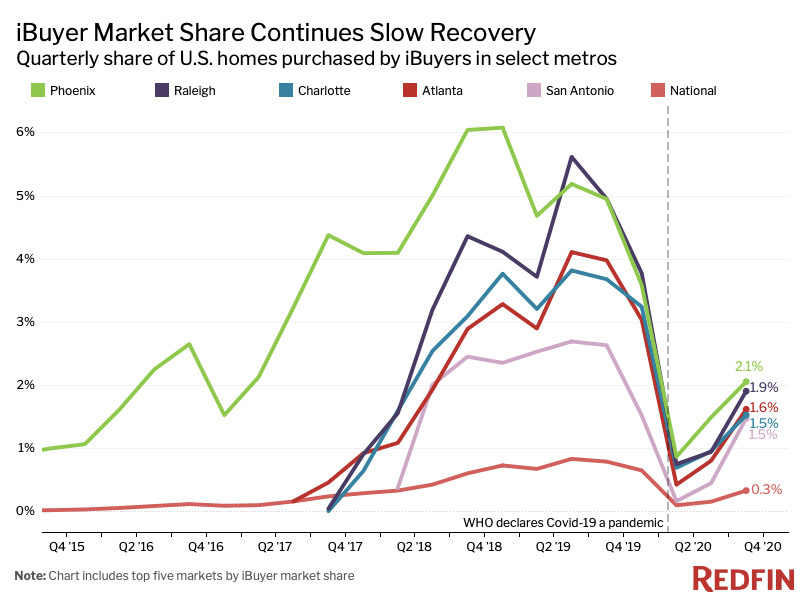

Is Zillow Offers Failure A Sign There Is Something Wrong With The Real Estate Market The San Diego Union Tribune

By listing FSBO you can avoid paying a listing.

. Zillow makes the data previously inaccessible andor prohibitively expensive available in the interest of greater transparency in the real estate market. Home assessors do tax zillow. Local governments use your tax assessment as the basis for your annual property tax bill.

Annual property taxes are determined by multiplying the assessed fair market value against the local property tax rate. NJ tax assessors arent dumb enough to use Zillow as a tool because Zillow is inaccurate garbage. Instead let the inefficient.

You can find your local tax assessor in this list if you need to pay your. Assessor right-Zillow wrong. Zillow doesnt tell the whole story.

They use actual tax records for sales. Your neighbors property that sold for. If youre listing on Zillow for sale by owner its likely because you dont want real estate commission fees to eat into your profits.

So if say the market value of your home is 200000 and your local assessment tax rate is 80 then the taxable value. Ive noticed that Zillows tax information on a property is significantly higher than the info I got from the county tax assessors website. It also provides a link to the county assessors website.

Reassessments of all property in the community are the best way for the assessor. But you savor misleading info and flat out false info so you should be a. I guess the question I now have is if the local county assessors offices are using Zillow when it comes to yearly new value.

Assessors strive to provide property owners with fair and accurate assessments. Louis County MO assessors dont use Zillow. To learn how assessors determine the value of property visit How property is assessed.

Similarly one may ask what is a tax assessment on Zillow. NJ tax assessors arent dumb enough to use Zillow as a tool because Zillow is inaccurate garbage. Appraisers have full access to the Multiple Listing Service MLS and have no professional need to use Zillow.

If you claim your home. The property assessors goal. Your Tax Assessment Vs Property Tax What S The Difference Understanding.

Property Tax How To Calculate Local Considerations

Online Home Valuation 10 Sites To Find A Home Appraisal

Exploit Online Data To Lower Your Property Taxes

Trulia Estimate Vs Zillow Zestimate Which Is More Accurate

How To Increase Your Zillow Zestimate House Sold Easy

Colorado Property Taxes Would Be Cut By 700 Million Under Deal

Zillow Assessor And Real Estate Database Ztrax Uw Data Collaborative

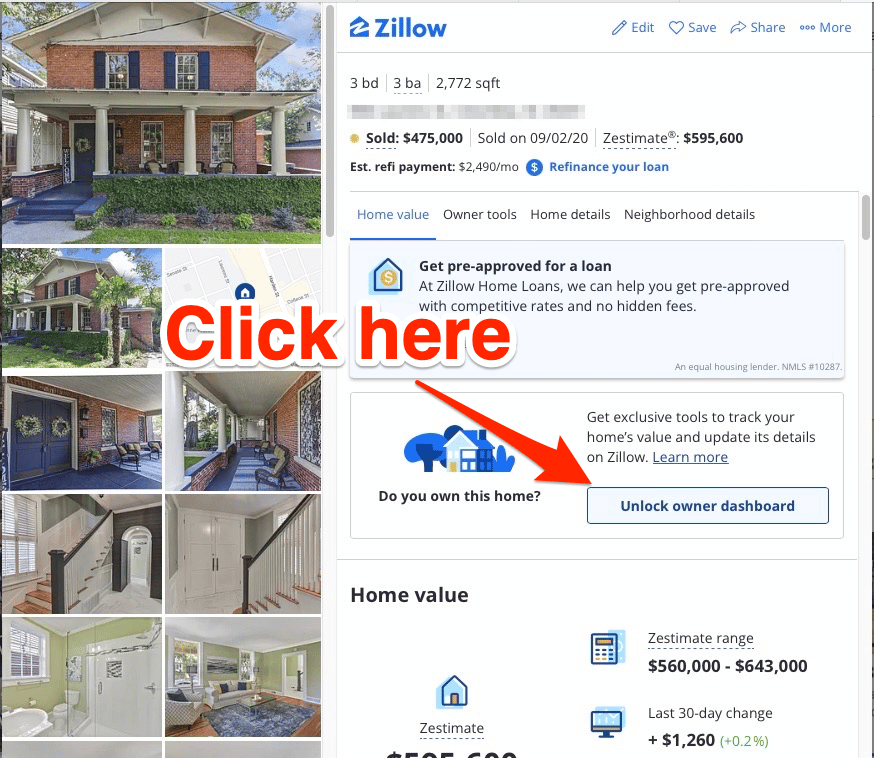

What Does Zillow Estimated Payment Include Hoa Taxes And More Home Decor Bliss

Where Does Zillow Get The Price And Tax History Data For My Home Zillow Help Center

What Is A Zestimate Zillow S Zestimate Accuracy Zillow

Teller County Property Records Database

280 Stevens Road Lynchburg Va 24501 Mls 338166 Listing Information Long Foster

Zillow Review What To Know Before Using 2022

What To Do When Your Property Tax Bill Increases

Property Taxes Too High Here S How To Appeal Them And Lower Your Tax Bill Cbs News

Assessed Value Vs Market Value What S The Difference

Use Bad Pricing Estimates By Zillow And Redfin To Your Advantage

Use Bad Pricing Estimates By Zillow And Redfin To Your Advantage

What Does Zillow Estimated Payment Include Hoa Taxes And More Home Decor Bliss